The economic situation in Europe and worldwide is currently facing many uncertainties. Globalization trends are in question after covid-19 pandemic and, more recently, also due to geopolitical risks. But as for our industry, IT custom software development stands on a stable foundation, has still a lot of potential for deeper international cooperation and a fatal recession is not imminent in our business.

Economic uncertainty

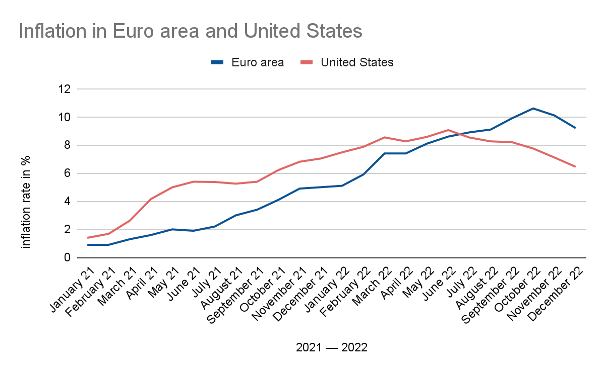

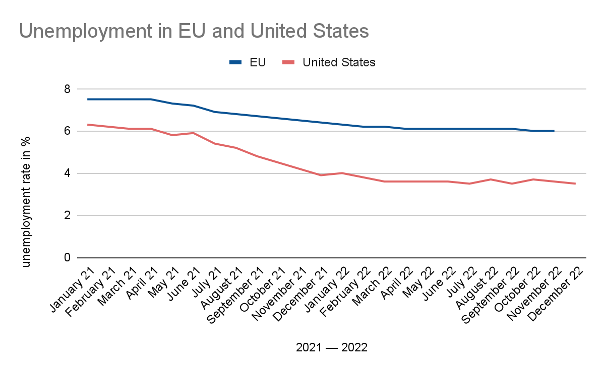

Many commentators predict a significant slowdown or even crisis within the European and global economies. The real situation is not, in my opinion, as bleak as many paint it. What I observe from market behaviour is more of uncertainty rather than crisis. Fortunately, inflation appears to be easing in key markets and unemployment is still at record lows, both across Europe and in the US. Moreover, most clients are not cutting back on orders, but are planning for shorter periods with monthly or quarterly budgets. The situation favours flexible players who listen to their clients and can respond flexibly to their needs.

source: Eurostat, BLS

source: Eurostat, BLS

source: Eurostat, BLS

source: Eurostat, BLS

Strengthening position

The continued attractivity of the IT sector is reflected by strong M&A activity. Major players in the IT business are on a shopping spree and the market is consolidating further. This consolidation is also in the interest of most clients, for whom IT and software are increasingly moving to the centre of their business. As a result, they need to entrust their contracts to reliable companies to manage risks involved, and can no more afford to work with smaller riskier suppliers for their core IT services. Clients are also interested in the quality and breadth of the offering, as suppliers with a broad portfolio of services and skills are gaining an advantage over smaller specialised entities. Companies in the IT sector are in high demand, and the idea of consolidation into larger units is supported by investors globally.

Globalisation vs. geopolitics

Globalization is not a new addition to the list of IT trends as interest among clients in near-shore or off-shore delivery has been growing for many years. While the covid-19 pandemic has severely crippled global supply chains and many manufacturers have begun to wonder whether they should move their global operations back closer to their home markets, in the IT world globalisation has continued mostly undisturbed. The Russian invasion of Ukraine, however, clearly showed the limits of globalization for the IT world as well, and reinforced the concept of friend-shoring. This concept still focuses on globalisation, but restricts it only to reliable and politically-allied countries. This puts Russia on the outside of this global economy, and also increasingly China and potentially other countries that are not politically aligning themselves with the Euro-Atlantic community. Therefore, in 2023 I expect to see further globalisation in IT services where language barriers allow, but now only within the circle of politically friendly and stable countries. Companies with linguistically equipped people in the right locations and a global sales network will still have a clear advantage and will be increasingly able to reach interesting clients from Silicon Valley to Singapore.